Canadians Over 75: Financially Stable, Well-Connected and Ready for More, But Folks in their 50s not so sure

TORONTO, ON (October 1, 2024) – A new survey commissioned by HomeEquity Bank reveals Canadian homeowners aged 75 and older are outshining their younger counterparts on key happiness markers, offering an insightful guide for younger generations entering a new life stage.

According to the survey, 95 per cent of Canadians 75 and older are very satisfied or somewhat satisfied with their lives, compared to just 79 per cent of Canadians in their 50s.

“Our purpose is to empower Canadian homeowners 55+ to have the freedom to do what they love for as long as they can and age with dignity in the home they love,” says Katherine Dudtschak, President and CEO of HomeEquity Bank. “Our latest study unpacks different happiness markers for Canadians and how they shift as they age. We found a sharp distinction between those approaching retirement and those well into it.”

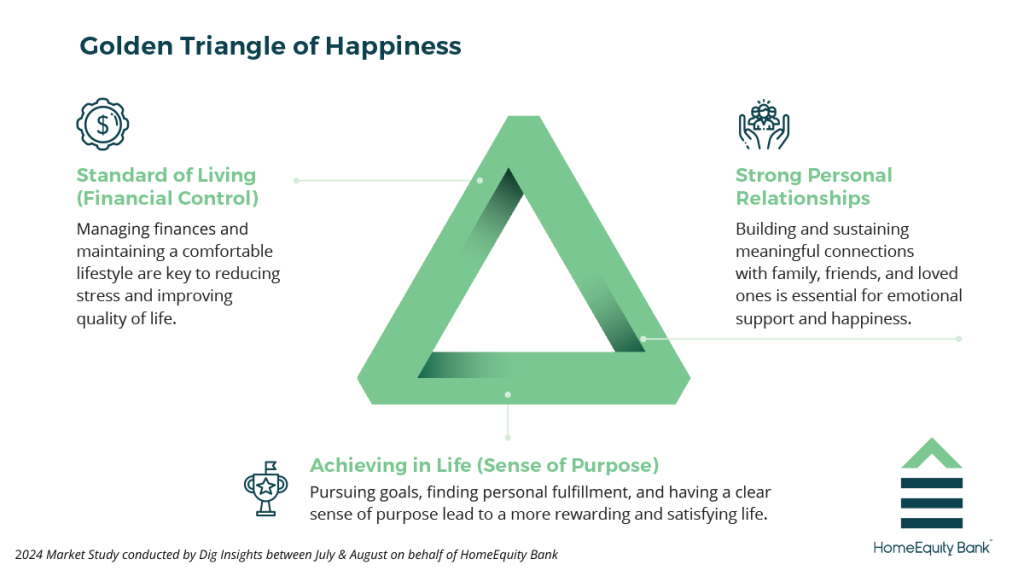

HomeEquity Bank used markers of happiness—financial stability, quality connections and sense of purpose—to frame the questions in the study. The results show:

- Financial Stability

- Just 48 per cent of Canadians in their 50s are feeling very good or even excellent about their finances, but that number jumps to 68 per cent at 75+

- Being able to handle a major unexpected expense, a key indicator of financial wellness, also improves with age (55 per cent versus 75 per cent)

- Quality Connections

- Feeling connected and experiencing quality friendships actually improves as people age from their 50s to being 75+ (70 per cent versus 85 per cent)

- Living in homes in good order and enjoyed by family members, another marker of connection, improves with age (81 per cent versus 89 per cent)

- Sense of Purpose

- Staying active in their communities shows a wide gap between those in their 50s and those 75+ (30 per cent versus 48 per cent)

- Giving back to the community and supporting charitable causes also increases with age (34 per cent versus 51 per cent)

The top anxieties among homeowners in their 50s include outliving retirement savings, not having enough to support themselves and the ability to leave behind a legacy they can be proud of. This concern is exacerbated by a shifting retirement landscape, which includes Canadians ageing with more debt, limited cash savings and shrinking pensions, while living longer with increasing and varied healthcare needs.

“To be fulfilled, you need to look at all facets of your life,” says Vivianne Gauci, Senior Vice President of Customer Experience, HomeEquity Bank. “Financial stability is a fundamental part of living a healthy and fulfilling life, but it’s not the only factor. Connections and purpose have critical roles to play, which is why enjoying a happy retirement requires a holistic approach.”

HomeEquity Bank is taking steps to bridge the gap to fulfillment as Canadians age by raising awareness about the need for purpose and connection alongside financial stability. The Bank is sharing its research findings in a report, Attaining Freedom: Embracing Growth, Fulfillment, and Financial Health as We Age, that offers insights into the evolving needs and aspirations of Canadian homeowners 45+ as they aim to achieve a fulfilling and secure future.

The Bank is also working alongside its partner, The Canadian Association of Retired Persons (CARP), to host a fireside chat, where the Bank’s Chief Financial Commentator, Pattie Lovett-Reid, will moderate a discussion between HomeEquity Bank’s President and CEO, Katherine Dudtschak, CARP’s Chief Operating Officer, Anthony Quinn, and Dr. Samir Sinha, a highly regarded clinician and international expert in the care of older adults, to provide Canadians with tools and insights for successful and purposeful ageing.

About HomeEquity Bank

HomeEquity Bank is a Schedule 1 Canadian Bank offering a range of reverse mortgage solutions including the flagship CHIP Reverse Mortgage™ product. The company was founded more than 35 years ago to address the financial needs of Canadians who wanted to access the equity of their top asset – their home. The Bank is committed to empowering Canadians aged 55 plus to live the retirement they deserve, in the home they love. HomeEquity Bank is a portfolio company of Ontario Teachers’ Pension Plan Board, a global investor that delivers retirement income for 340,000 current and retired teachers in Ontario. For more information, visit www.chip.ca.

About the Survey

Included above are some findings from a Dig Insights survey conducted between July 22 and August 2, 2024 on behalf of HomeEquity Bank.

For this survey, a sample of 1,602 Canadians aged 55+ were interviewed with the following criteria:

- Gen-pop proportions by gender and region

- Primary/shared financial decision-maker for household

- Homeowners with at least 50% equity in their home

Weighting was then employed to balance demographics to ensure that the sample’s composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe.

This survey has a margin of error at plus or minus 2.5 percentage points, 95% of the time, on questions where opinion is evenly split. The margin of error is higher among subsets of the population.

All sample surveys may be subject to other sources of error, including, but not limited to coverage error, and measurement error. All figures cited in this release are based on those who have formed an opinion on the matter and exclude ‘don’t know’ or ‘not applicable’ responses.

Media requiring further information or booking an interview, please contact:

HomeEquity Bank, Vivianne Gauci, SVP Customer Experience, (416) 413-4661, vgauci@heb.ca

Weber Shandwick for HEB, Adam Bornstein, (905) 505-2540, abornstein@webershandwick.com.