HomeEquity Bank Listed on the 2016 PROFIT 500

TORONTO, Sept. 15, 2016 /CNW/ - Canadian Business and PROFIT today placed HomeEquity Bank on the 28th annual PROFIT 500, the definitive ranking of Canada's Fastest-Growing Companies. Published in the October issue of Canadian Business and at PROFITguide.com, the PROFIT 500 ranks Canadian businesses by their five-year revenue growth. HomeEquity Bank, the only national provider of reverse mortgages in Canada, placed 475 on the 2016 PROFIT 500 list, thanks to a five-year revenue growth of 80%. The company's total revenu

Continue Reading...

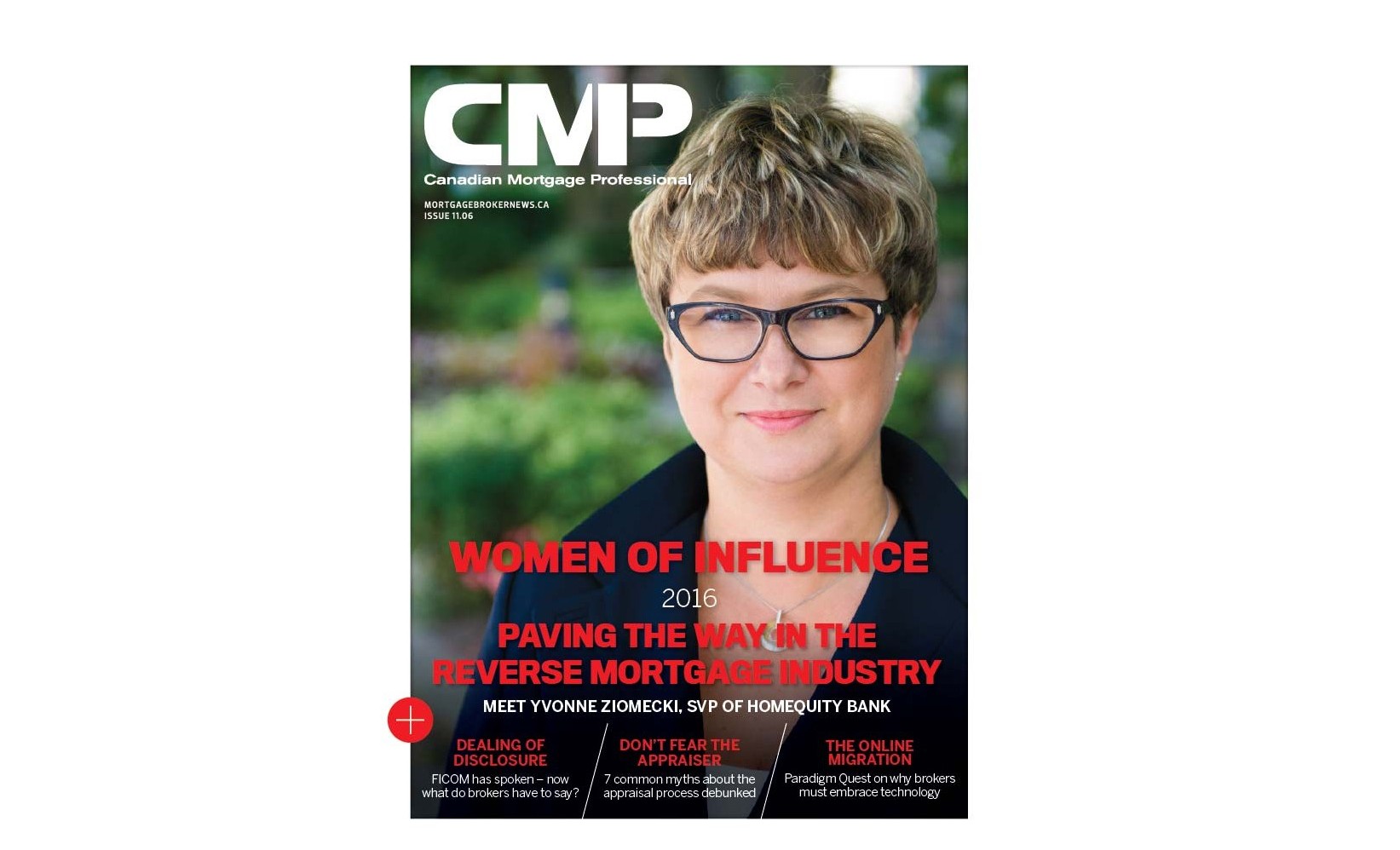

Yvonne Ziomecki named one of CMP Magazine’s Women of Influence

TORONTO, July 6, 2016 – HomeEquity Bank is pleased to announce that Yvonne Ziomecki, SVP, Marketing & Sales is named one of Canadian Mortgage Professional (CMP) Magazine’s Women of Influence. In the issue out on stands now, Yvonne credits the power of a strong network and support system as her secret to consistent results and her coveted work-life balance. “Balancing work with personal life, especially the needs of my children and finding time for myself, it’s not always easy. Having a strong network is key.

Continue Reading...

HomeEquity Bank announces partnership with Kurt Browning

TORONTO, June 22, 2016 /CNW/ - HomeEquity Bank, the only Canadian bank working exclusively with seniors, is proud to announce its new spokesperson is Canadian figure skating icon Kurt Browning. Kurt Browning is a Canadian figure skater, choreographer and commentator. He is a four-time World Champion and four-time Canadian national champion. "We're thrilled to be partnering with Kurt," said Yvonne Ziomecki, SVP, Marketing & Sales at HomeEquity Bank. "It was important to us to work with someone Canadians view as tru

Continue Reading...

HomeEquity Bank launches Mortgage Broker Direct

TORONTO, Sept. 14, 2015 - HomeEquity Bank launches its new “Mortgage Broker Direct (MBD)” program this week. For the first time, mortgage brokers will be able to submit deals directly to the bank via D+H Expert upon being certified. Last year, HomeEquity Bank’s broker business saw a growth of 39%, with over 1,000 mortgage brokers sending in referrals with an average deal size of $150,000. The Mortgage Broker Direct program through HomeEquity Bank will offer a no-fee certification process to a limited number of mortg

Continue Reading...

HomeEquity Bank 2015 Retirement Study

In a first-of-its-kind study HomeEquity Bank has asked Canadians about their hopes and plans for retirement.The goal is to compare Canadians’ financial expectations for retirement with their financial reality once they finish working. Download the complete report View the full infographics: [gallery link="file" ids="661,660,659"]

Continue Reading...

Peter Mansbridge challenges the perception of retirement by asking the right questions

Award-winning journalist and author Peter Mansbridge has been appointed Strategic Communications Consultant for HomeEquity Bank TORONTO – Jan. 8, 2024 – There are few voices Canadians trust more to get the right answers than award-winning journalist and author Peter Mansbridge. HomeEquity Bank, Canada’s only federally regulated bank exclusively serving Canadians 55+ has engaged Peter Mansbridge as Strategic Communications Consultant. The intent of the collaboration is to help HomeEquity Bank refresh the con

Continue Reading...

HomeEquity Bank successfully closes its inaugural $175 million Deposit Note offering

Toronto, December 11, 2023 – HomeEquity Bank ("HEB" or the "Bank") today announced that it has concluded its inaugural issue of $175 million of deposit notes due December 11, 2026 (the “Deposit Notes”). The Deposit Notes are senior unsecured obligations of HEB. The Deposit Notes have a coupon of 7.108% per annum, paid semi-annually commencing June 11, 2024. DBRS Morningstar has assigned HEB’s Deposit Notes a rating of BBB (low) with a Stable trend. CIBC Capital Markets and TD Securities acted as joint bookrunne

Continue Reading...

HomeEquity Bank named among Greater Toronto’s Top Employers for living our values at work

2024 winners selected for progressive policies and culture reflecting evolving employee expectations TORONTO – Dec. 5, 2023 – HomeEquity Bank, provider of the CHIP Reverse Mortgage, is pleased to announce it has been recognized as one of Greater Toronto’s Top Employers for 2024, acknowledging the organization’s ongoing investment in its employees’ well-being and workplace culture. Presented by Mediacorp Canada Inc.—organizers of the annual Canada’s Top 100 Employers project—the 2024 Greater Toront

Continue Reading...

Honouring troops and tradition, HomeEquity Bank proudly presents Digital Poppy fundraiser for 5th year

Canadians can donate to get a Digital Poppy to support the Legion National Foundation Oct. 27-Nov.11 at MyPoppy.ca HomeEquity Bank has been supporting the Legion National Foundation as presenting partner of the digital fundraiser since 2018 Letters-Home.ca brings Veterans’ letters online to forge a unique connection between this generation and those who served TORONTO – Nov. 1, 2023 – For the fifth year, HomeEquity Bank is the proud presenting partner of the Digital Poppy campaign, supporting the Legion Na

Continue Reading...

Smashing Stereotypes: When it Comes to Financial Well-being, Older, Single Women are Leading by Example

New HomeEquity Bank survey reveals two groups of women 55+ enjoying higher financial wellness scores: women who are solely responsible for their finances and older women who actively rely on financial advice As women age, they are better able to enjoy life if they feel their finances are well-managed. Advisors: women value your professional advice but more than half remain skeptical that it is readily available to them. TORONTO, September 20, 2023 – Findings from a new survey released today from HomeEquity Ba

Continue Reading...