Bucket list versus inheritance? Canadian seniors pick wish list

TORONTO, Sept. 28, 2016 /CNW/ - When it comes to bucket list versus inheritance, Canadian seniors have spoken: 86% are unwilling to forgo doing, achieving or acquiring something in order to provide a larger inheritance to their adult children. That's according to the results of an August, 2016 Seniors' Views of Inheritance study conducted by HomeEquity Bank and Ipsos Canada. "Seniors are not feeling pressured about leaving an inheritance," explains Yvonne Ziomecki, SVP, HomeEquity Bank. "They're very comfortable with wan

Continue Reading...

Steven Ranson is named 2016 EY Entrepreneur Of The Year Finalist

TORONTO, July 8, 2016 – HomeEquity Bank is pleased to announce that Steven Ranson, President & Chief Executive Officer has been named a finalist for the 2016 EY Entrepreneur Of The Year. This recognition as a finalist places Steve in one of the most prestigious networks of entrepreneurs in the world. Steve Ranson has been the driving force of Canada's only reverse mortgage provider for the last 19 years. His business acumen, perseverance, courage, composure, independent thinking and integrity have been essential

Continue Reading...

HomeEquity Bank announces partnership with Kurt Browning

TORONTO, June 22, 2016 /CNW/ - HomeEquity Bank, the only Canadian bank working exclusively with seniors, is proud to announce its new spokesperson is Canadian figure skating icon Kurt Browning. Kurt Browning is a Canadian figure skater, choreographer and commentator. He is a four-time World Champion and four-time Canadian national champion. "We're thrilled to be partnering with Kurt," said Yvonne Ziomecki, SVP, Marketing & Sales at HomeEquity Bank. "It was important to us to work with someone Canadians view as tru

Continue Reading...

For Millennials, buying a home is a distant dream unless parents help with down payment

For parents, a reverse mortgage can provide funds TORONTO, June 13, 2016 /CNW/ - Young Canadians living in hot housing markets such as Vancouver and Toronto are increasingly looking to their parents for help with down payments when it comes to purchasing their first home. And, for parents who have seen the value of their homes rise dramatically in the last 10 years, a reverse mortgage is often an attractive way to assist adult children. That's according to HomeEquity Bank experts, who are helping more Canadian senior

Continue Reading...

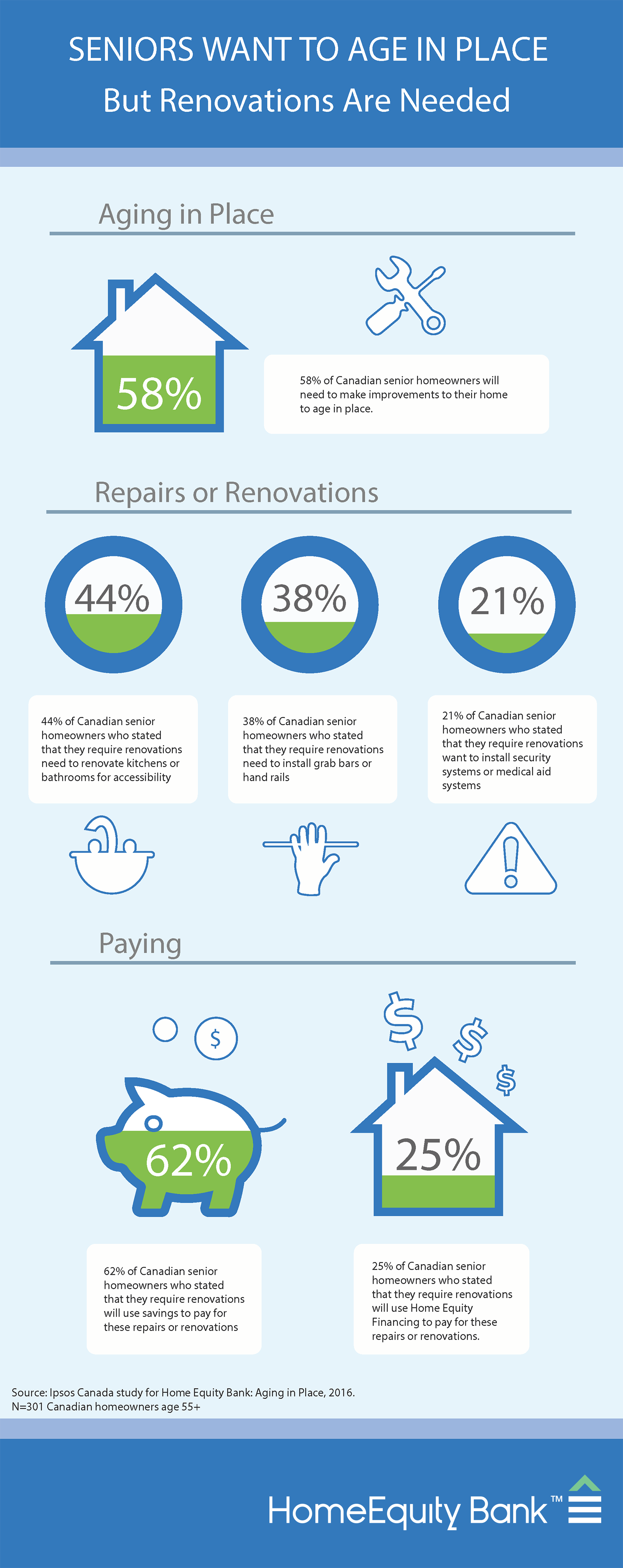

Seniors want to age in place, but study shows 58% must renovate

HomeEquity Bank teams with Ipsos Canada to study top renovations required TORONTO, April 6, 2016 /CNW/ - Most Canadian seniors want to remain in the family home as they age, but often must renovate and retrofit areas of the home as part of aging in place. That's according to the results of a study conducted by HomeEquity Bank and Ispos Canada, where 300 Canadian homeowners were surveyed from March 15th to 18th 2016. The study focused on Canadians aged 55 and older and asked if renovations were needed to remain in t

Continue Reading...