Doctors, lawyers and dentists just like everyone else

TORONTO, Feb. 23, 2016 /CNW/ - High income earners such as doctors, lawyers and dentists are often perceived as 'rich' and lucky to experience a comfortable, financially stress-free retirement. Yet, according to Mac Killoran, Tax Partner, Fruitman Kates LLP Chartered Accountants, this is not always the case. Professionals are just as likely to encounter money troubles late in life and he's seen this with his own clients. "I see it quite often, where high income earners sell their practice and retire, but still spend m

Continue Reading...

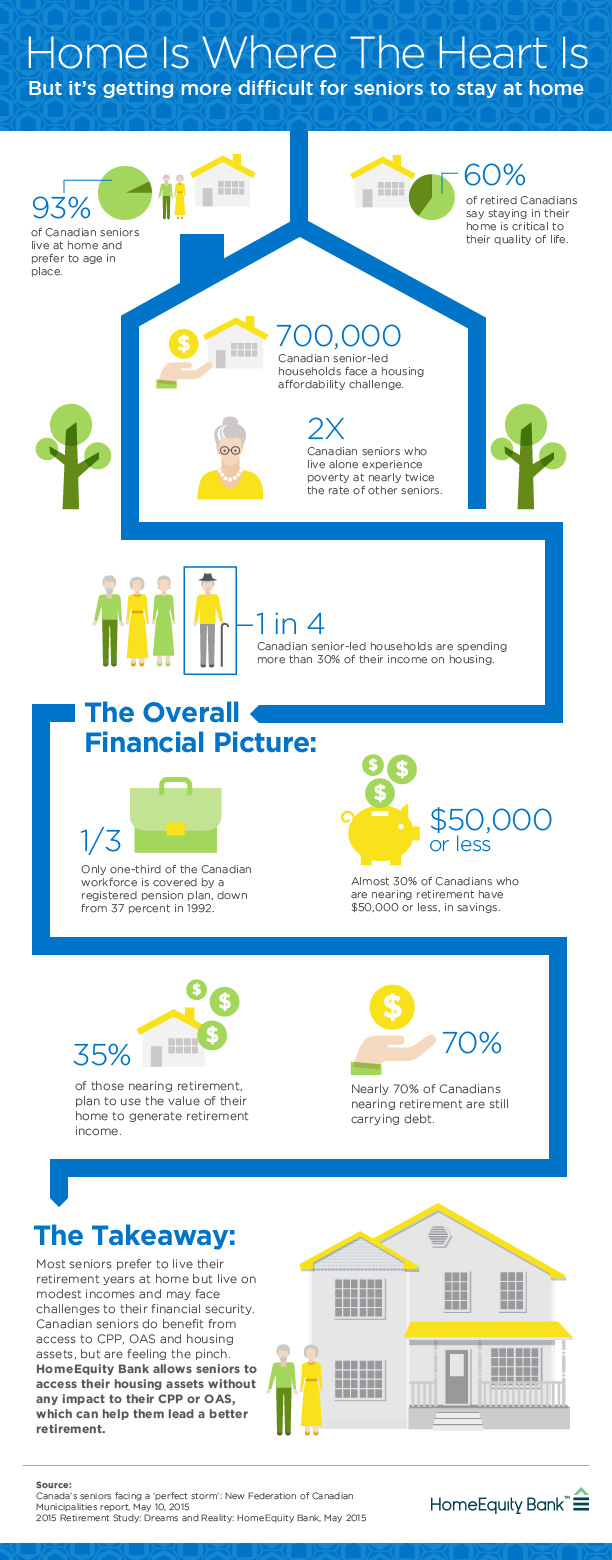

Home Is Where The Heart Is

HomeEquity Bank stats show seniors plan to use home to generate income TORONTO, Dec. 15, 2015 /CNW/ - Canadian seniors consistently report that they prefer to live at home and age in place. Yet, they also report that financial challenges are the biggest hurdle to doing so. A recent report from the Federation of Canadian Municipalities (FCM) shows that 93% of seniors live at home and prefer to age in place. And, HomeEquity Bank statistics support this, reporting that 60% of retired Canadians describe staying in their h

Continue Reading...

What should seniors expect from the new Liberal government?

TORONTO, Nov. 17, 2015 /CNW/ - Canadian seniors worried about finances may be wondering what changes they can expect now that a majority Liberal government has been elected. "The comments we hear from seniors, every day, are that government changes are needed to areas affecting finances. Some are struggling while others face dire financial challenges," notes Yvonne Ziomecki, SVP, HomeEquity Bank, the only bank dealing exclusively with seniors. "The most important promise of the Liberal government to retirees is what i

Continue Reading...

Seniors aged 70+ carrying more debt than ever before

HomeEquity Bank teams with Equifax Canada to study Debt in Retirement TORONTO, Sept. 10, 2015 /CNW/ - Mortgage debt among seniors is increasing right across Canada, and for those aged 70+ it has increased 12% compared to 2013. That's according to the results of a Debt in Retirement study conducted by HomeEquity Bank and Equifax Canada. The study was conducted in July, 2015 and focused on Canadians aged 55 and older. It analyzed the main categories of debt including: mortgages, lines of credit, bank loans, car loans,

Continue Reading...

HomeEquity Bank Reports Record Originations Growth

TORONTO, Aug. 4, 2015 /CNW/ - HomeEquity Bank announced record $41MM in reverse mortgage origination in the month of July. July marks yet another month of record YOY growth for the reverse mortgage company established in 1986. July YTD originations of reverse mortgages by HomeEquity Bank grew by 21% YOY. The strong YOY growth can be attributed to an increase in consumer direct business as well as continued growth through referral partners including banks and mortgage brokers. "With the current demographic trends and exten

Continue Reading...