Lori Sone-Cooper, VP of HR for HomeEquity Bank named to Human Resources Director Canada Magazine’s Hot List 2017

Lori Sone-Cooper, VP of HR for HomeEquity Bank named to Human Resources Director Canada Magazine's Hot List 2017 featuring 30 of the most outstanding HR professionals in the country. This year’s report features the people who continue to add value to the HR profession and increase its standing in the business world. Some of the professionals on this list have appeared on previous Hot Lists and proved their continued growth; while HRD also welcomes new contenders who have launched innovative initiatives and tackled tough

Continue Reading...HOMEEQUITY BANK POSTS RECORD 26 PER CENT GROWTH IN 2016

TORONTO, January 25, 2017 - HomeEquity Bank, providers of the CHIP Reverse Mortgage™, reported $459MM in reverse mortgage sales for 2016. This represents a 26 per cent increase over the year previous, demonstrating a growing demand by Canadian seniors to unlock the value of the equity in their homes. These strong 2016 results reflect a significant increase in HomeEquity Bank’s mortgage broker business, which has grown 48 per cent year over year following the successful introduction of the bank’s Mortgage Broker Dire

Continue Reading...

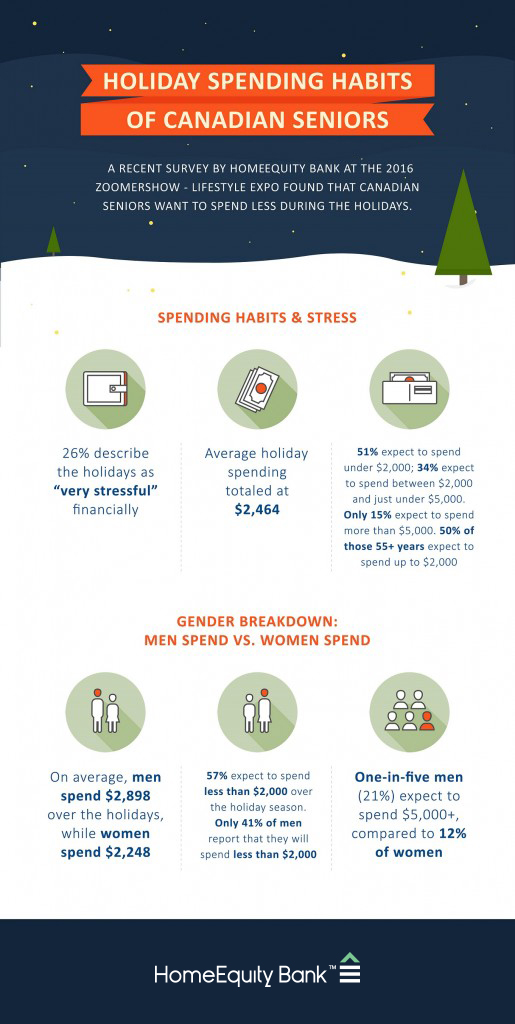

Canadian Seniors Want To Spend Less During The Holidays

TORONTO, December 21, 2016, - The holidays may not necessarily be a merry time of year for all Canadian seniors according to a recent survey of attendees at the Toronto ZoomerShow, ZoomerMedia’s lifestyle expo for people aged 45 plus. The survey, sponsored by HomeEquity Bank, providers of the CHIP Reverse Mortgage™, found that many seniors overspend during the holiday season. In fact, 26% of respondents described the holidays as financially “very stressful”. A total of 632 Toronto ZoomerShow attendees were surveye

Continue Reading...

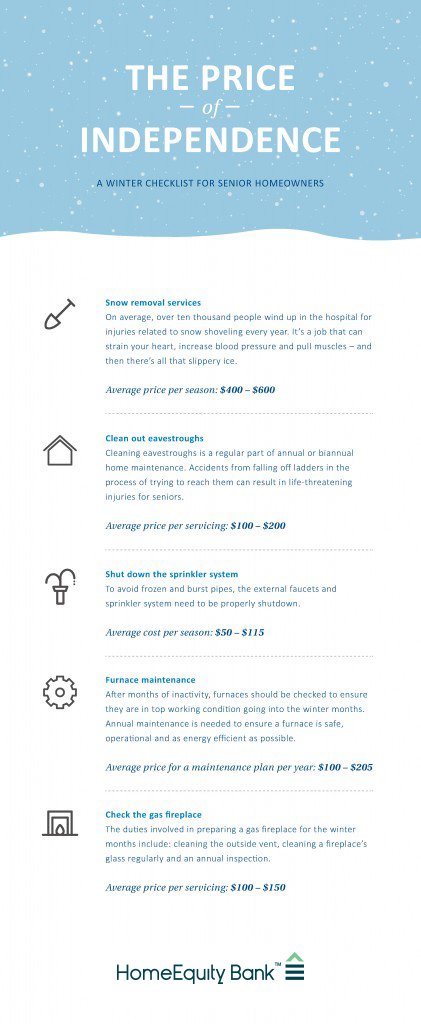

The Price of Independence – A Winter Checklist for Senior Home Owners

Most seniors have a strong desire to remain independent – and live in their own homes. That said, the onset of winter can present a number of challenges to peace of mind. In addition to the high cost of heating a house, there are a number of seasonal maintenance issues that need to be addressed – and paid for. Whether it’s a conversation and encouragement from adult children or a case of careful budgeting, here are some of the services – and attached costs:

Continue Reading...

Reality Gap Threatens The Financial Health Of Canadian Seniors: HomeEquity Bank Research

TORONTO, November 24, 2016, - At a time when Canadian seniors are living longer and healthier lives, their financial fitness requires close attention. Recent research sponsored by HomeEquity Bank, providers of the CHIP Reverse Mortgage™, indicates there is a startling gap between the lifestyle expectations of those Canadians 40+ years and the reality. The study, which looked at the financial health and viability of Canadian seniors, was national in scope and focused on Canadian residents, 40 years or older who own their

Continue Reading...